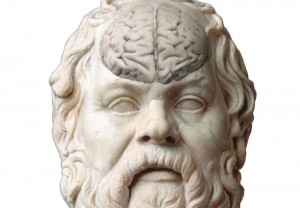

Mild Cognitive Impairment and Decision Making

Many elderly citizens have dementing illnesses such as Alzheimer’s disease or multi infarct dementia, and will experience difficulties with decision making, even in early and sometimes pre-dementia states. By the year 2050, Alzheimer’s disease is projected to affect between 11 and 16 million people in the United States, and this figure does not include other dementing illnesses such as trauma or stroke related dementias. In addition, accompanying neuropsychiatric changes such as agitation, depression and anxiety also affect decision-making. The cognitive deficits and emotional changes which accompany dementing illnesses have serious ramifications for the legal system, for example in making medical decisions, consenting to experimental treatments, entering into contractual arrangements, undertaking financial obligations, operating a motor vehicle or composing a last will and testament. Despite the growing magnitude of this problem, there is little uniformity of approach or outcome when courts attempt to assess an elderly person’s capacity to make such decisions.

Aging and Elder Fraud Prevention Project

Elder financial exploitation is a significant and costly problem, with various forms of fraud impacting millions of older adults each year. As our society ages, these problems are becoming more prevalent and complex, and they demand comprehensive and innovative solutions. The Center for Law, Brain & Behavior (CLBB) has mounted a four-pronged initiative to enhance protections for vulnerable older adults.

WHITE PAPER

Joined by senior financial services leaders and neuroscientists, CLBB scholars are producing a white paper, Elder Financial Fraud: Balancing Autonomy and Protection for Vulnerable Elders. In addition to information about aging and cognitive decline, the White Paper will include instruments to assess financial decision-making, as well as analyses of cases of maltreatment and exploitation of elders. The White Paper will enable trust attorneys, fiduciaries, financial advisors, and probate and family court judges to take more measures to protect older clients’ financial assets, while balancing that protective duty with independence and autonomy.

FORUMS ON THE AGING BRAIN AND ELDER FRAUD PREVENTION

On November 16, 2023 and April 23, 2024, CLBB hosted two Forums on the Aging Brain and Elder Fraud Prevention for financial services and banking professionals, judges, disability and elder rights attorneys/advocates, and medical professionals with experience in elder populations. Participants reviewed drafts of CLBB’s White Paper that uses neuroscience knowledge to enhance protections against financial fraud and exploitation for elders in cognitive decline. The completion and dissemination of the White Paper will be followed by a pilot project mounted with several investment advisory firms to test recommendations regarding regulatory and ethical compliance and protection of their clients.

PILOT PROJECT

In development is a plan to collaborate with a select group of financial advisement firms to test recommendations proposed in the White Paper. Key elements will include: an assessment tool to gauge clients’ financial incapacity; administration of the assessment at age thresholds, such as 55, 60, or 65 years; the use of a machine-learning app, such as a voice-to-text tool to make the assessment process more efficient; determination of the impact of assessment on the advisor-client relationship; and integration of assessment into firms; internal procedures and policies in accordance with FINRA Rules 2165 (Disbursement Holds) and 4512 (Trusted Contact Person).

TRAINING OF JUDGES

CLBB and the Federal Judicial Center conduct an annual seminar for federal judges that includes a unit on cognitive impairment and financial fraud. Since the majority of fraud cases are handled in state courts, CLBB also mounts seminars for state judges including those serving in probate and family courts. Training sessions geared to probate judges from Massachusetts will begin in Spring 2024, and CLBB hopes to expand teachings for this judicial constituency to other states. The White Paper will provide the foundation for this training.

Capacity, Finances & the Elderly: Brain Science Meets the Law

Watch video from the “Capacity, Finances & the Elderly: Brain Science Meets the Law” event, featuring Drs. Rebecca Brendel, Ekaterina Pivovarova and Bruce Price, Hon. Susan Ricci, and Atty. Susan Stenger, moderated by Boston Globe health reporter Kay Lazar.